RECAP AMA CRYPTOVN X TERRA NETWORK

We are pleased to announce the next ama: CRYPTOVN X Terra Network

⏰ Time: 9:00AM EST. September 08, 2020.

The ama session will have 3 parts:

?1. Introduction

?2. Answer question on Twitter – Drop you question here

?3. Free asking

?4. Quiz: We will randomly select 10 winners with the correct answer – Join here

? Total prizes: $300 LUNA

Terra is a price-stable cryptocurrency designed for mass adoption. It builds financial infrastructure for the next generation of decentralized applications.

Terms:

• Group:

@TerraLunaChat

@cryptovn_group

• Channel:

@terra_announcements

@cryptovn_news

• Website :

https://terra.money

https://cryptovietnam.vn/

Host:

Hello @Hwangarang

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

hello 🙂

Host:

Nice to see you here )

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

great to be here

Host:

Can we start AMA now?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

sure

Host:

Cool

The ama session will have 4 parts:

?1. Introduction

?2. Answer question on Twitter

?3. Free asking

?4. Quiz: We will randomly select 10 winners with the correct answer

We can go to part 1 now

Are you ready?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

ok

Part 1

Host:

1. Can you introduce yourself and your role at Terra Network?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

sure

I am the head of ecosystem development at Terra

I manage the ecosystem verticals of 3rd party development, validators, community, and research.

My joining of Terraform Labs stemmed from understanding the problems that the developer communities have been working on. From Terra’s emphasis on exposure to non-crypto natives, I have been working to continue the mass adoption of Terra’s products from the CHAI payments app that has successfully reached almost 2 million users, the launch of Anchor transforming the interchain DeFi space, to many more products which will give users the opportunity to be exposed to this transformative technology.

I graduated from Johns Hopkins University with a M.S. in Computer Science where I focused on cryptography and health technology applications. I also have a bachelors degrees in Computer Science from the University of Maryland, College Park and Biology and Religion from Swarthmore College.

Terra is building new financial infrastructure that works better for everyone. The network is powered by a family of stablecoins, each pegged to major fiat currencies all algorithmically stabilized by Terra’s native governance and staking token, Luna. Terra’s mission is simple: set money free by building open financial infrastructure.

<Luna>

Luna, as the native staking asset from which the family of Terra stablecoins derive their stability, utility, and value, acts both as collateral for the entire Terra economy and as a staking token that secures the PoS network. Luna can be held and traded as a normal cryptoasset, but can also be staked to accrue rewards in the network generated from transaction fees. Luna can also be used to make and vote on governance proposals.

<Terra>

The family of Terra stablecoins achieve stability through consistent mining rewards with a contracting and expanding money supply. For example, if the system has detected that the price of a Terra currency has deviated from its peg, it applies pressure to normalize the price. Currently, the family of Terra stablecoins include: KRT (Terra stablecoin pegged to Korean Won), UST (Terra stablecoin pegged to US Dollar), MNT (Terra stablecoin pegged to Mongolian Togrog), SDR (Terra stablecoin pegged to IMF SDR), with more being added in the future.

<Smart Contracts>

The power of multi-chain operable smart contracts is a key feature that Terra has also been working to add. Powered by CosmWasm, these smart contracts are able to interoperate natively with the ecosystem of Cosmos blockchains with IBC (InterBlockchain communication). These smart contracts leverage the speed of WASM and the power of Rust and securely address most known attack vectors seen on Ethereum.

<Mass Adoption>

Terra has made enormous strides in mass adoption within payments space from the Chai payments app built on its platform. Chai has risen to become one of the most popular applications built with blockchain with over 3% of the South Korean population using Chai to pay for goods and services ranging from Korea’s #1 online travel agency, #1 bookstore, #1 gaming publisher, #1 convenience store, the top e-commerce sites, and many more. As of August 2020, Chai currently has over 1.9 million users, an annual run rate of $1 billion, and has shown an average retention rate of over 80% when used with multiple merchants.

<DeFi and Anchor>

Terra will also be launching Anchor. Anchor is a DeFi protocol that leverages the block rewards of every major PoS blockchain to power yields on stablecoin deposits. Anchor aims to become the “gold standard for passive income in blockchain.” It will be offering principal protection, instant withdrawals, and a steady and high APR.

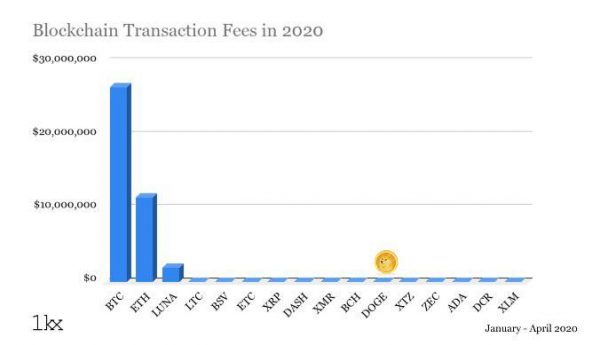

The Terra ecosystem has approached and achieved mass adoption that has resulted from solid go-to-market strategies with strong mechanism design. This has resulted in over $78 million in transaction fees within a 3 month period, over $25 billion GMV exposed to the over 1.7 million users on Chai, and placing 3rd in total transaction revenue only behind that of Bitcoin and Ethereum.

When Terra was created in January 2018, it had the singular vision of facilitating the mass adoption of cryptocurrencies by creating digitally native assets that are price-stable against the world’s major fiat currencies. Keeping in mind that previous innovations in the technology of money was bootstrapped by large payment networks (Alipay with Taobao, Paypal with eBay, Visa with banks), Terra was born with the support of the Terra Alliance, 15 large e-commerce companies in Asia that collectively process 25 billion USD in annualized transaction volume and 45 million users. The vision of the project is that with the adoption and user engagement of a massive payment network, it will be able to, for the first time, bootstrap a blockchain payment network to the scale it deserves and facilitate far more powerful products and use cases through its infrastructure.

<Terra and DeFi>

Terra is successfully bringing DeFi to the masses with payments, savings, and much more. The Chai payments app has exploded in growth with over 1.9 million users, an annual run rate of over $1 billion, and widespread integration with merchants that range from Korea’s top e-commerce stores, #1 online travel agency, #1 bookstore, #1 game publisher, #1 convenience store, and many more. Through payments, Terra has successfully bridged the gap between the traditional world and the blockchain world. Many existing DeFi products are not built for the masses and suffer from extreme volatility, complicated on-boarding, accessibility issues, and sometimes near-ponzinomics style get rich quick schemes. The Anchor protocol (anchorprotocol.com) is a savings product that stands firmly as a representation of what DeFi looks like. It ensures immediate usability, no complications with hours of research to understand, or unfair advantage to early adopters. Anchor leverages the block rewards of every major PoS blockchain to power yields on stablecoin deposits. Anchor aims to become the “gold standard for passive income in blockchain.” As a default, it offers principal protection, instant withdrawals, and a steady and high APR. Terra’s approach to mass adoption and mature products in its ecosystem is what has brought more than $4.9 million in tax rewards ranking Terra 3rd behind Bitcoin and Ethereum. True, tangible yields from actual adoption from real external value flowing into Terra’s networks is a testament to what the DeFi space is becoming to address and unlock the potential for the multiple billions of dollars that will enter the right ecosystems, Terra’s in particular.

Host:

Wow, what a great introduction, thank you. ?

We can go to part 2 now

I have 10 questions from Twitter

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

sure

Part 2

Host:

First question for you

1. @andri050196

what is TERRA_NETWORK what are the benefits we get from TERRA_NETWORK because there have been many promising projects that have finally disappeared, not in accordance with the initial fission and mission?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Terra is a blockchain layer 1. We are built using the Cosmos SDK. The benefits of Terra are first and foremost the efficiency and scalability — 10-14,000 TPS with 250 bytes of data. We have also achieved mass adoption. We have over 2 million users. The narrative that exists is that we have achieved mass adoption through abstraction. While many projects have been focused on fighting over the same small group of crypto-natives, we targeted the rest of the world—and succeeded. Our transaction fees accumulated (in a fee-based system, not an inflation based one) ranks us third, just behind Bitcoin and Ethereum

done

Host:

Cool

Next queston

2. @Pamoato

What is the difference between Terra SDR ($SDT) and Terra USD ($UST), what is the function of each one within the platform and how is it possible to obtain them? Thank you!

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Good question. Terra SDR, Terra USD, Terra KRW, and Terra MNT are all Terra stablecoins. We do not just have 1 stablecoin, but a family of stablecoins. The value that exists with having many stablecoins exists because of the existing ease of access and usability for different regions. For example, a product in one country could have a value of 0.005 USD while in another country a value of 1 USD. There is a natural difference in denomination. This is very similar to the reason why it is very difficult for Bitcoin to be adopted as an easy payment method. No one wants to try to get used to using something like 0.00001357 Bitcoin to pay for something. Similarly a region should use stablecoins that exist in their denomination.

done

Host:

Thank you for great answer ?

Next question

3. @Pamoato

Is $LUNA part of Terra? If so, how is it different from SDR ($SDT) and Terra USD ($UST)? Why are there so many tokens on the platform? Are they all tradeable? Thank you!

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Yes, Luna is part of Terra

We have 2 token types: Terra stablecoins and Luna.

Terra stablecoins are the stablecoins as you are aware of. And Luna is the native staking/governance token that also acts as the stability mechanism for Terra Stablecoins

Luna, as the native staking asset from which the family of Terra stablecoins derive their stability, utility, and value, acts both as collateral for the entire Terra economy and as a staking token that secures the PoS network. Luna can be held and traded as a normal cryptoasset, but can also be staked to accrue rewards in the network generated from transaction fees. Luna can also be used to make and vote on governance proposals.

The family of Terra stablecoins achieve stability through consistent mining rewards with a contracting and expanding money supply. For example, if the system has detected that the price of a Terra currency has deviated from its peg, it applies pressure to normalize the price.

done

Host:

Thank you for great answer

Next question

4. @ketuart02

The price of Luna is relatively very stable in the range of 0.20 for 7-8 months, is this tied to the staking rewards “inflating” or is the price dependent on chai volume? I have pinned different valuation models arguing for a higher price but somewhere there is a price inhibition

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Interesting question. The value of Luna is natively tied to demand. From a very high level: the more demand for Terra stablecoins (for example if many people want to use Chai to pay for something and that requires the obtaining and usage of terra stablecoins), there is a price deviation because of that demand on the terra stablecoin. This would mean that there needs to be algorithmic pressure to stabilize the peg. The way this happens is that there are more Terra stablecoins minted. Whenever a stablecoin is minted, Luna is burned. So there is actually deflationary pressure on the Luna token which would decrease the supply and make it more scarce. More information on valuation can be found here: https://medium.com/terra-money/the-role-of-transaction-fees-in-network-valuation-and-security-90540c422ff

As to what has happened in the past few months. As user transactions have increased in the past few months, the marketcap and value have similarly increased 3-4x. As to the overall general cryptocurrency markets, there have been correlations to how the rest of the market does. For example what we saw recently, the entire cryptocurrency market falls together

Host:

Thank you for great answer ?

Next question

5. @JuliaWhite22

what happens to the security of Luna’s network when we will all rush to stake on Anchor? As far as I know, we need stablecoins for Anchor, so won’t Luna be burned and its value go up?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

We have not yet released details on how Anchor will operate or how the Anchor governance tokens will be released and operate. However, I will let you know how Anchor works. Anchor is a savings product that generates high APR. There is guaranteed principal protection. What you do is, deposit Terra stablecoin and portions of those deposits go to take staking positions on integrated proof of stake networks. Our V1, coming out in November will start with Terra. V2 (next year) will include Polkadot, Cosmos, and Solana

There is no burning necessarily

it will be more Luna staked and locked up

done

Host:

Cool

5 questions left

next one

6. @ketuart02

Many public chains are pushing towards DeFi. For example, TRON also launched its JUST project this year. What do you think are the advantages and opportunities of Terra in this space?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Terra from its core provides scalability and efficiency. As I mentioned, with Tendermint (from using Cosmos SDK) we have 10-14,000 TPS. Anchor is DeFi, Chai is DeFi. But there are many existing DeFi applications that have yet to come out natively on Terra. That is an exciting space for developers to build on ( so please come ahead and build what you want to see on Terra!) Also, we have Ren bridge in progress that will allow Terra assets to be used in Ethereum coming soon, so you can use Terra within the popular Ethereum DeFi products!

done

Host:

Next question

7. @Ksalom95

why is Terra Network really looking to “make payments in Asia to all parts of decentralized finance globally”? isn’t this CLASSIST? Why not be able to make payments from anywhere in the world to other countries?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Interesting question. Terra is not just in Asia, but focused globally. Chai, the payments app built on Terra, started in Korea but will not be localized to Korea. It recently had a softlaunch of its card (Chai Card) which will be accessible globally

done

Host:

Next one

8. @Rosanela08

Terra’s mission is to free people from the hidden fees embedded into everyday payments. How will this change the experience of users in comparison of what they live daily into e-commerce? Where are the hidden fees we don’t see?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Good question. Let’s use payments as an example

Chai integrates with traditional merchants.

In Korea, Chai has integrated with broad adoption—number 1 convenience store, number 1 online travel agency, number 1 online gaming publisher, top e-commerce, etc

traditional payment rails make merchants pay 2-3% per transaction

On terra, 0.6%

That is enourmous savings

Merchants love it!

done

Host:

Interestingly, it greatly reduces transaction fees ?

Next one

9. @CaahJony

How active is CHAI using the Terra blockchain? And what about the correlation with Anchor Protocol regarding the recent Defi Alliance announcement? I would like to know what concept it is?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Chai actively uses it every single day! You can look at information on Chai at Chaiscan.com! You’ll see some awesome metrics.

Let’s take a look now

This is real time

and what it looks like now

today, 52,000 active users

Host:

Look good

TOTAL USERS

1,914,303

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

over 1.4 million dollars transacted

let’s take a look at august monthly active users

over 600k monthly active users in August

only within the first week of september we can see it is already almost 300k active users

imagine the end of september, the number will be much much larger than 600k

Host:

Awesome ???

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

We see 32,000 new users were added within one week

this volume *directly* correlates with how the Terra blockchain is used

because our network is fee-based and not inflation based

let me take a quote from a piece I wrote recently that illustrates the importance of being fee-based and not inflation-based

https://medium.com/terra-money/the-role-of-transaction-fees-in-network-valuation-and-security-90540c422ff

“The valuation of a PoS network is generally thought to be a function of the rewards that accrue to the staking asset discounted to the present. Most PoS networks reward validators either via transaction fees or inflation rewards.”

“As we have argued in the past, we believe that transaction fee rewards provide an objective basis for network valuation, while inflation rewards do not. In the case of Luna, transaction fees represent value that is captured externally (consumers and merchants paying to use Terra), as opposed to value issued internally (inflation). We believe that this property of externally captured rewards sets Luna apart from the vast majority of PoS assets.”

“Let’s imagine a fictitious inflation-based PoS token called Mare (sea) that pays a 10% annual yield. This means that if Alice stakes 10 Mare for a year, the network will print 1 new Mare and give it to her as a reward. If Bob holds 10 Mare over the same period without staking he receives no reward. What’s essentially happened here is that Alice’s share in the network has increased (her stake relative to Mare’s total supply), while Bob’s has decreased. In other words, the network has used inflation to redistribute Mare ownership, thereby taxing people like Bob who do not stake. What if everyone stakes (say Alice and Bob, the only two holders)? Then they both maintain their network ownership, so their yield net of inflation is zero. In other words, staking in an inflation-based PoS network is a way to protect one’s ownership from being diluted, and “yield” is a measure of punishment for not doing so rather than a measure of reward. It is safe to assume that at steady state, the majority of holders will stake precisely for this reason. All in all, knowledge of Mare’s “yield” leaves us none the wiser as to what it is worth.

Contrast this reward system to one based on transaction fees like Luna’s: when value is transferred on the Terra network, Luna captures a small fraction of that in the form of Terra rewards. This happens every time someone uses Terra to transact or make a purchase. Hence, value external to the network accrues to Luna in a predictable manner, i.e. proportionally to aggregate “value flow”. In our case the underlying economy from which value is captured is well understood — the fast growing Asian e-commerce market which Chai is rapidly infiltrating. It is in this vein that we are able to conduct straightforward analysis to project the value that will accrue to Luna over time. What is more, value accrues in a fiat-pegged currency (Terra) rather than in the staked asset (Luna), thus creating an objective basis for quantifying said value. Discounting Terra to the present is meaningful; discounting Luna to the present is circular.

The stark contrast between value-based and inflation-based rewards mechanisms has significant implications for valuation of the PoS asset. Assets which are rewarded in value-capture terms are easy to value: one simply needs to project value flow (in our case: Terra transaction volume) and the rate of value capture (in our case: transaction fee). On the contrary, inflation-based rewards offer zero basis for valuation — as we saw earlier the “yield” of a PoS asset has nothing to say about its value, only about how fast it inflates (how fast it loses value). To value such assets, one needs to resort to more ill-defined methods that are independent of their yield. The ability to value an asset in a systematic way is a core requirement for sustainable demand. We see Luna’s value-based rewards system as a significant advantage relative to its PoS peers.”

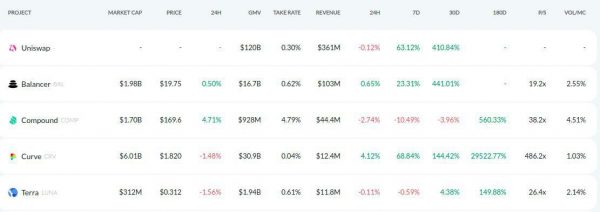

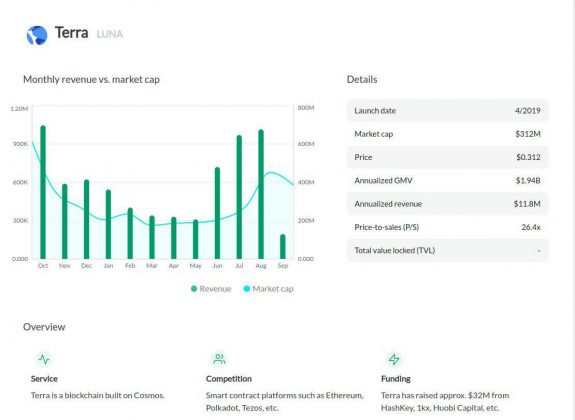

You can also see that Terr ranks within the top 5 for total revenue as seen on tokenterminal.com

Host:

Nice to see it

Are you finish your answer for this question?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

yep

done

Host:

Cool

Last one

10. @TonyMon253

Terra and REN Protocol works together to bring Terra Stablecoins to Ethereum, but apart of this , Which others Network Will be added too? TRON too?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

We already built a bridge with Solana: https://medium.com/terra-money/terra-partners-with-solana-to-establish-low-latency-bridge-expanding-its-stablecoin-ecosystem-to-15883bdbb0fb

we are in the works of building bridges with other networks as well (many have reached out to us to build them and have Terra stablecoins in their networks)

ethereum will be established via ren

many more that I cannot officially announce yet either

done

Host:

Thank you for the aweosme answers to part 2. We’ll take a two minute break and go to part 3 =)

ok? @Hwangarang

Guys, please take some time to see very detailed answers from Daniel ?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

ok!

Host:

We back

We will go to part 3: Free asking from community

I will open chat in 3 mins, people will drop they question here.

Then you can choice best top 5 or 10 questions and answer it. Ok?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

ok

Part 3

1. @DiegoRME

Investors seem to only care about the price of the token instead of the real value of the project, how does Terra attract newcomers and keep members long-term with the project? What is the real value of Terra?

@Hwangarang

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Mass adoption through abstraction. We have found real use in non-crypto natives—over 2 million of them. That provides consistent and growing demand for our stablecoins, providing deflationary pressure on Luna, and the fees and rewards for our Luna holders.

2. @zaferce

What is the difference of Terra compared to other payment systems? What benefits will you provide to the payment system besides the prevention of additional costs?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

We algorithmically stabilize. Chai also offers discounts and cashback. You can see it happen real time here: https://twitter.com/richbuildingown/status/1299882391951958016?s=20

3. @asalas95

What does Terra expect from your collaboration with CJ O Shopping? Do you have plans to join other retail chains in the medium term?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Chai has integrated with many merchants. I will list a few from the past few months:

> AfreecaTV, one of the largest streaming platforms in Korea (and beyond) boasting 12 million users and 3.5 million DAU

> Yogiyo, Korea’s food delivery giant owning 33% of the multi-billion dollar Korean food delivery market, integrated with CHAI. In a country with a food delivery-loving culture unlike any other, we’re not surprised to see Yogiyo transactions already heavily contributing to total network volume.

> Interpark Ticket, Korea’s #1 ticketing site with over 70% ownership of the K-entertainment ticket market

> CGV, Korea’s #1 cinema giant with 50% ownership of the Korean cinema market and international branches across seven other countries

> WeMakePrice, korea’s #2 e-commerce platform (over $5 billion in GMV)

> Kyobo, Korea’s #1 bookstore

> Nexon, Korea’s #1 game publisher

4. @Ahmed1760

DeFi and Dapps are two pillars primed to rule cryptocurrencies, what’s your strategy to DeFi and Dapps?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

We are creating our own native dApps and DeFi (anchor and more!) We will also have a direct connection via Ren bridge to ethereum to get Terra into ethereum DeFi applications

5. @AugusS7

really why call this project “Terra” and its tokens “LUNA”? What does the stability of a currency have to do with the LUNA?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

The family of Terra stablecoins achieve stability through consistent mining rewards with a contracting and expanding money supply. For example, if the system has detected that the price of a Terra currency has deviated from its peg, it applies pressure to normalize the price.

6. @nichiao

Do you have plan for staking ?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Luna is a native staking asset. You can choose which validators to stake on here: station.terra.money

7. @zzcuna

Regulation is very complicated, I see that not all of country in ASIA can use LUNA debit Cards. What is your next strategy to pass this barrier!?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Chai card will have a mastercard available soon. So anywhere mastercard is accepted, Chai card will be accepted 🙂 Very huge!

8. @FFdior

what are the ways that LUNA Token generates profits/revenue to maintain your project and what is its revenue model ? How can it make benefit win-win to both invester and your project ?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

Our network is fee-based. Every single transaction has a fee. That has led to the total fee accumulation of over $5 million. This ranks Terra as 3rd behind Bitcoin and Ethereum. Please read here: https://medium.com/terra-money/the-role-of-transaction-fees-in-network-valuation-and-security-90540c422ff

and here: https://feedweave.co/post/84v1ElMk7FwJ77LD-bRq9HFr8fYqmydonO4HglYG56U

This is a picture from April 2020, it is now much higher!

9. @nichiao

Your metamorphosis is a laudable one, how have you been able to survive this longest bear market and continue building and developing cos many projects have died out in this time period?

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

solid product market fit! We have many more projects coming out as well. Mass adoption through abstraction has served Chai well and it has grown incredibly quickly. Over 2 million active accounts now!

Host

Thank you for join AMA guys @Hwangarang

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

thank you all!

Host

For part 4. we will choice 10 winners on twitter

We will post winner list later =)

Thanks for your time

Daniel Hwang – Head of Ecosystem Development @Terraform Labs:

ok

Terra’s channels:

twitter: twitter.com/terra_money

medium: medium.com/terra-money

discord: https://discord.gg/q58H7G

telegram: @TerraLunaChat

AMA winners list:

| No | User name | |

| Part 2 | 1 | @andri050196 |

| 2 | @Pamoato | |

| 3 | @Pamoato | |

| 4 | @ketuart02 | |

| 5 | @JuliaWhite22 | |

| 6 | @ketuart02 | |

| 7 | @Ksalom95 | |

| 8 | @Rosanela08 | |

| 9 | @CaahJony | |

| 10 | @TonyMon253 | |

| Part 3 | ||

| 11 | @DiegoRME | |

| 12 | @zaferce | |

| 13 | @asalas95 | |

| 14 | @Ahmed1760 | |

| 15 | @AugusS7 | |

| 16 | @nichiao | |

| 17 | @zzcuna | |

| 18 | @FFdior | |

| 19 | @nichiao | |

| Quiz | ||

| 20 | @trolleat | |

| 21 | @diamanterus | |

| 22 | @ThongPham95 | |

| 23 | @zeus_collector | |

| 24 | @ErmatovJohon | |

| 25 | @ChuZshen | |

| 26 | @QuyenTr0902 | |

| 27 | @Kingoftheshell3 | |

| 28 | @NguyenD54307392 | |

| 29 | @Lennon18garcia |